The Social Security Administration has several provisions surrounding Retirement Benefits, Widow Benefits, and Retroactive Benefits. These three areas come together in the scenario where a newly widowed spouse is trying to understand and best utilize the Social Security claiming options now available. Let us start with understanding how retroactive benefits work.

Retroactive Benefits

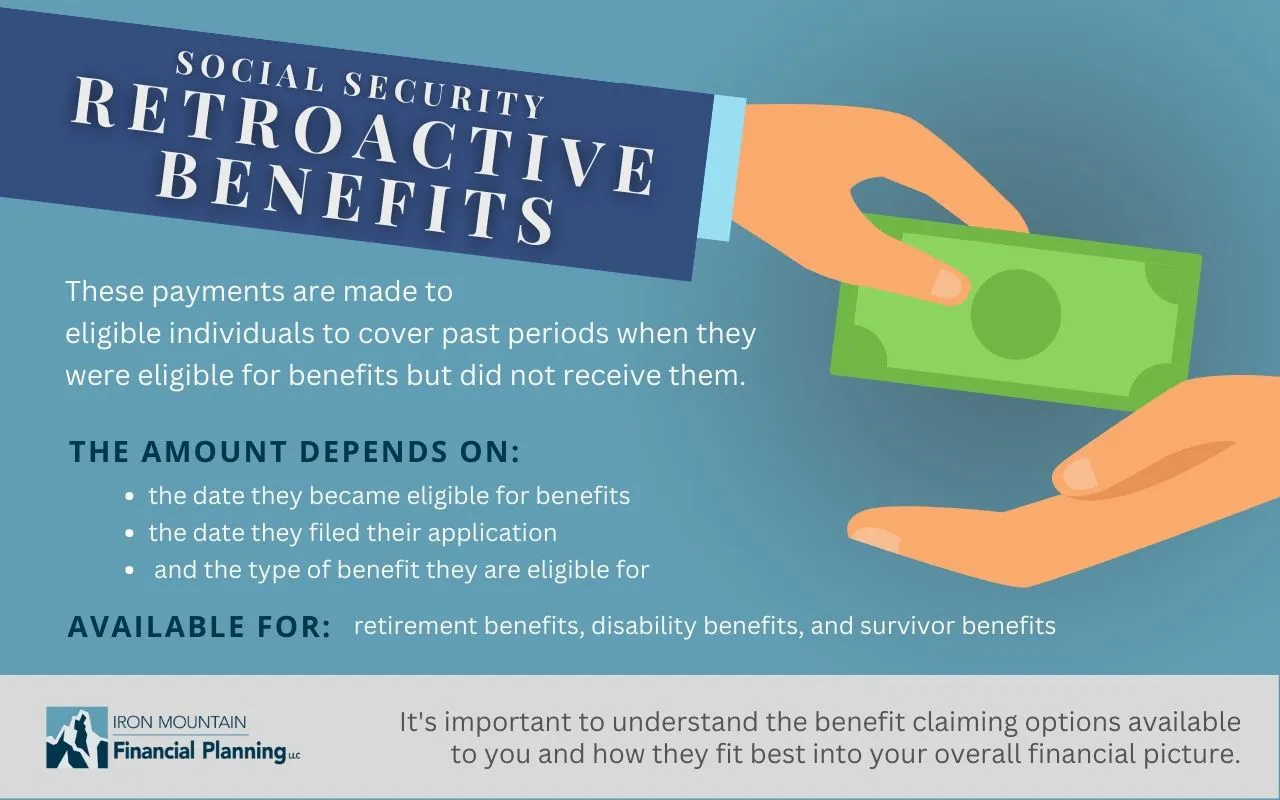

Social Security retroactive benefits are payments made to eligible individuals to cover past periods when they were eligible for benefits but did not receive them. These payments are typically made as a lump sum and can be claimed by individuals who have recently become eligible for Social Security benefits or who have had their benefits increased.

The Social Security Administration will generally pay retroactive benefits to eligible individuals who file their application for benefits after their date of eligibility. The retroactive payment covers the period between the date the individual became eligible for benefits and the date they filed their application for benefits. This means that if an individual becomes eligible for benefits on January 1st but does not file their application until June 1st, they may be eligible to receive retroactive benefits for the months of January through May.

The amount of retroactive benefits an individual may be eligible for will depend on several factors, such as the date they became eligible for benefits, the date they filed their application, and the type of benefit they are eligible for. Retroactive benefits may be available for a variety of Social Security benefits, including retirement benefits, disability benefits, and survivor benefits.

It’s important to note that there are limits on the amount of retroactive benefits an individual can receive. For example, for retirement benefits, retroactive payments are typically limited to six months of benefits. However, for disability benefits, retroactive payments may be available for up to twelve months of benefits.

With a basic understanding of the rules around retroactive benefits, let us move on to Widow Benefits.

Widow Benefits

Widow benefits are a type of Social Security benefit available to surviving spouses of workers who have died. These benefits are designed to provide financial assistance to widows who have lost their primary source of income and may be struggling financially as a result.

To be eligible for widow benefits under Social Security, the following requirements must be met:

- The widow must be at least 60 years old (50 years old if disabled), or caring for a child who is under the age of 16 or disabled and entitled to benefits on the deceased worker’s record.

- The deceased worker must have earned enough Social Security credits to be insured for benefits. In general, a worker earns one credit for each $1,470 of earnings in 2021, up to a maximum of four credits per year.

- The widow must have been married to the deceased worker for at least nine months prior to their death, or meet one of several exceptions, such as if the death was accidental or if the widow is caring for the deceased worker’s child.

If these requirements are met, the widow may be eligible to receive a monthly benefit based on the deceased worker’s earnings. The amount of the benefit will depend on a variety of factors, such as the widow’s age, the deceased worker’s earnings history, and the widow’s filing status.

In addition to monthly benefits, widows may also be eligible for a lump-sum death benefit of $255.

This benefit is available to widows who were living with the deceased worker at the time of their death, or who meet other requirements.

Let us now turn to the third topic of Retirement Benefits based on the widow’s own work history.

Widow’s Own Retirement Benefits

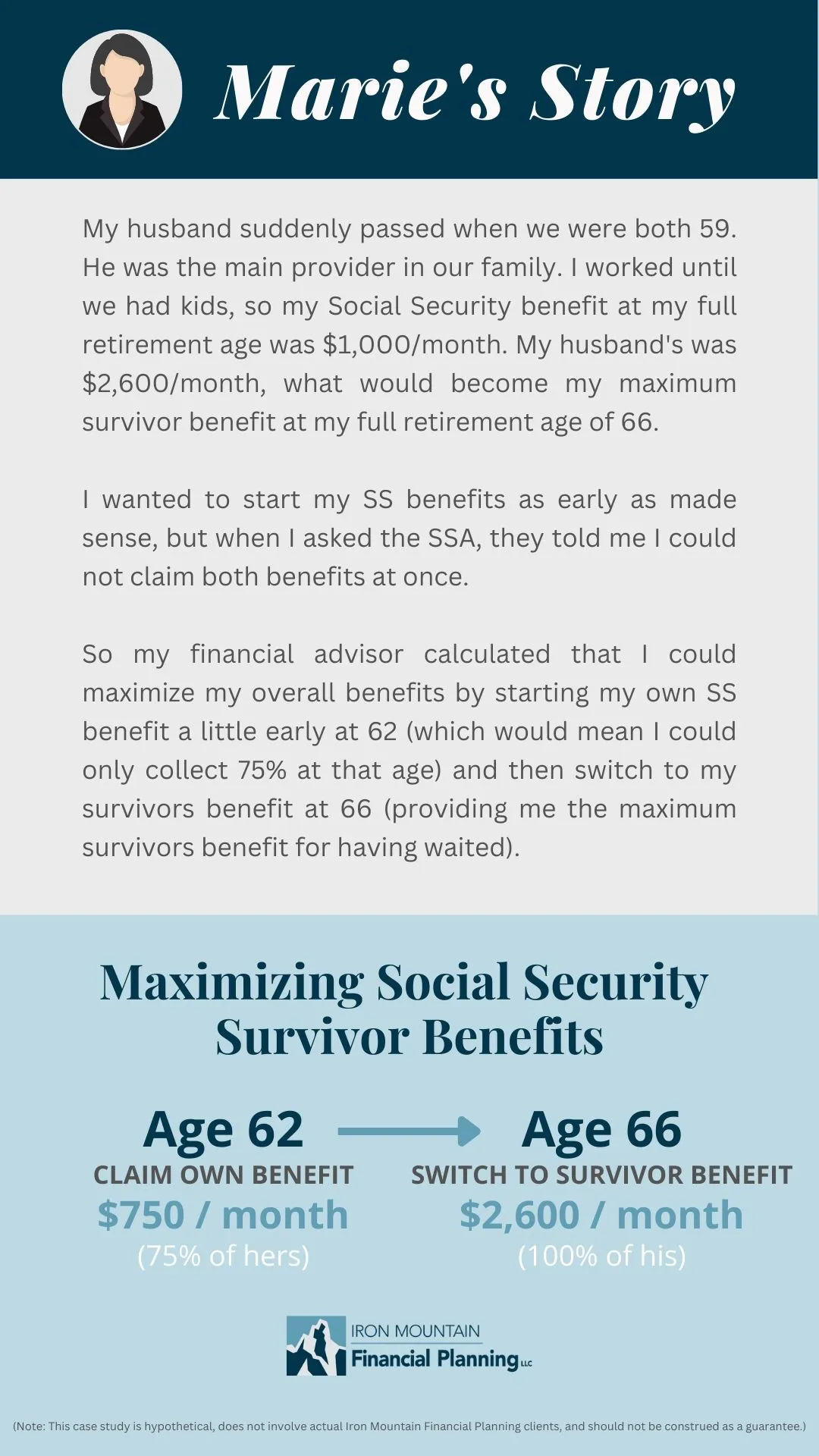

If the widow is also eligible for Social Security retirement benefits based on her own work history, then the amount of her Social Security retirement benefit is based on her average earning over her working years. The Social Security Administration calculates the benefit amount using a complex formula that takes into account the individual’s earnings history and the age at which they begin receiving benefits. The benefit amount is adjusted for inflation each year to help ensure that it maintains its purchasing power.

Individuals can begin receiving Social Security retirement benefits as early as age 62, but the benefit amount will be reduced if they begin receiving benefits before their full retirement age. Conversely, individuals who delay receiving benefits beyond their full retirement age, up to age 70, may be eligible for an increased benefit amount also referred to as Delayed Retirement Credits.

Putting Them Together

Widow benefits can provide a critical source of financial support to widows who have lost their spouse and are struggling to make ends meet. It’s important to understand the eligibility requirements and how to apply for benefits to ensure that the maximum benefit available is received.

When a widow is eligible for both widow benefits and retirement benefits based upon her own work history, she has the option to start with one benefit and switch to the other at any time. However, this switch is a one-time event and cannot be undone.

If you believe you may be eligible for Social Security retroactive benefits, it’s important to contact the Social Security Administration as soon as possible to determine your eligibility and to file your application for benefits.

Retroactive benefits can provide a significant financial boost, but the rules can be complex.

Like most aspects of retirement and tax planning, many recently widowed are not sure where to turn and choose to elect the option a friendly neighbor or well-intentioned sibling suggests. For those who would like some unbiased professional help, my financial planning service includes retirement and tax planning services that encompass integrating the complex Social Security claiming options into a comprehensive retirement income plan.

If help understanding the Social Security claiming options available to you and how they fit best into your overall financial picture is of interest to you, click here to schedule a time to talk.