New income tax brackets have just been released. The IRS standard deduction and marginal tax rates are the basic building blocks of ongoing tax planning. They are adjusted annually for inflation. Understanding where your household falls in these marginal tax brackets is instrumental in understanding the expected tax implications of various tax planning strategies.

The IRS recently announced the new 2023 annual inflation adjustments for more than 60 tax provisions. In this article we will walk through the changes to the standard deductions, annual gift exclusion and marginal tax brackets for the most used filing statuses.

Further details for all the annual adjustments for 2023 can be found on the IRS website using this link (IRS Revenue Procedure 2022-38)

Increases to the Standard Deduction for 2023

The standard deduction increases by $1,800 to $27,700 for married couples filing jointly for tax year 2023 and increases by $900 to $13,850 for single taxpayers.

Increases to the Annual Gift Exclusion for 2023

The annual exclusion for gifts increases by $1,000 to $17,000 for calendar year 2023.

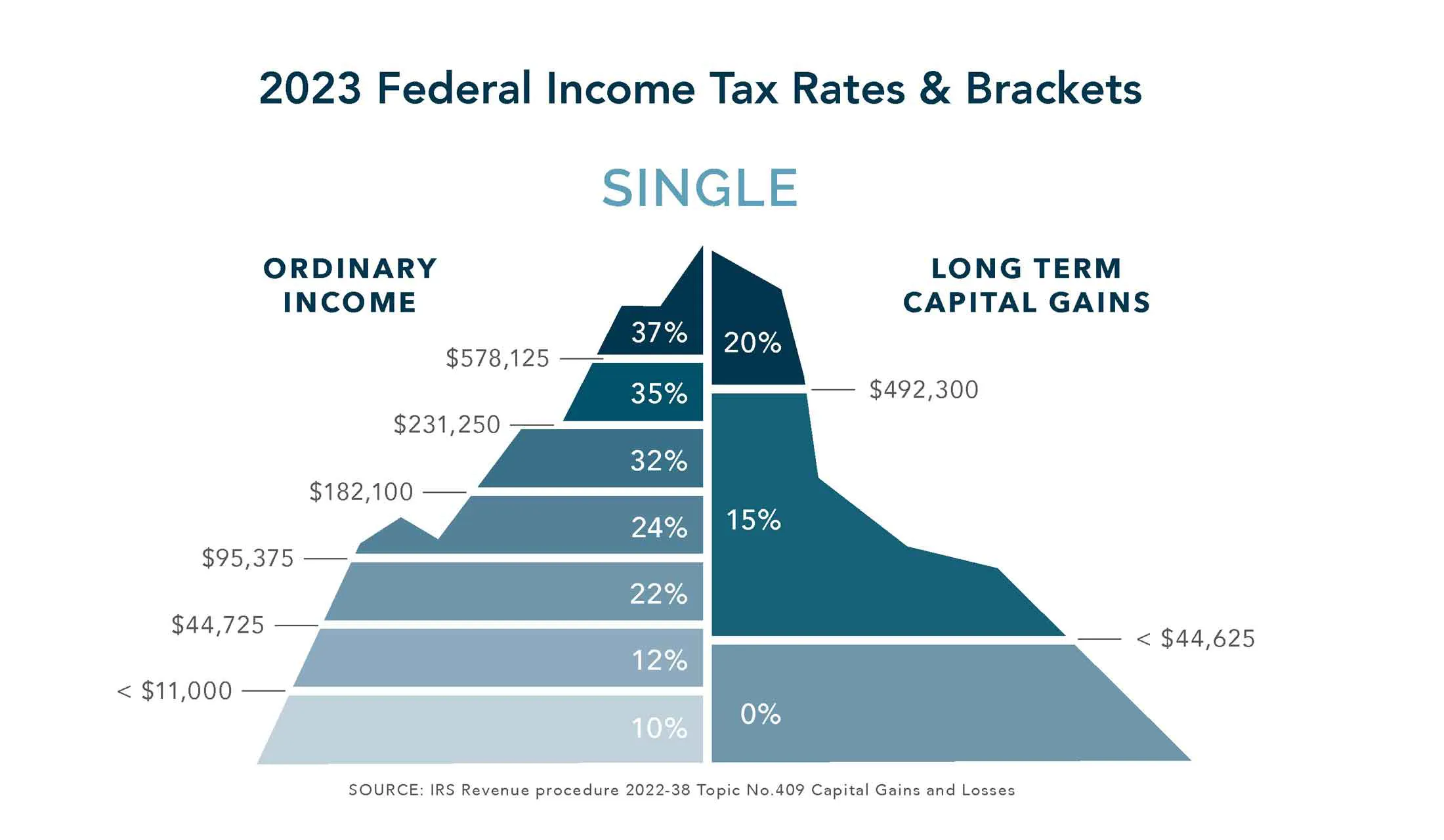

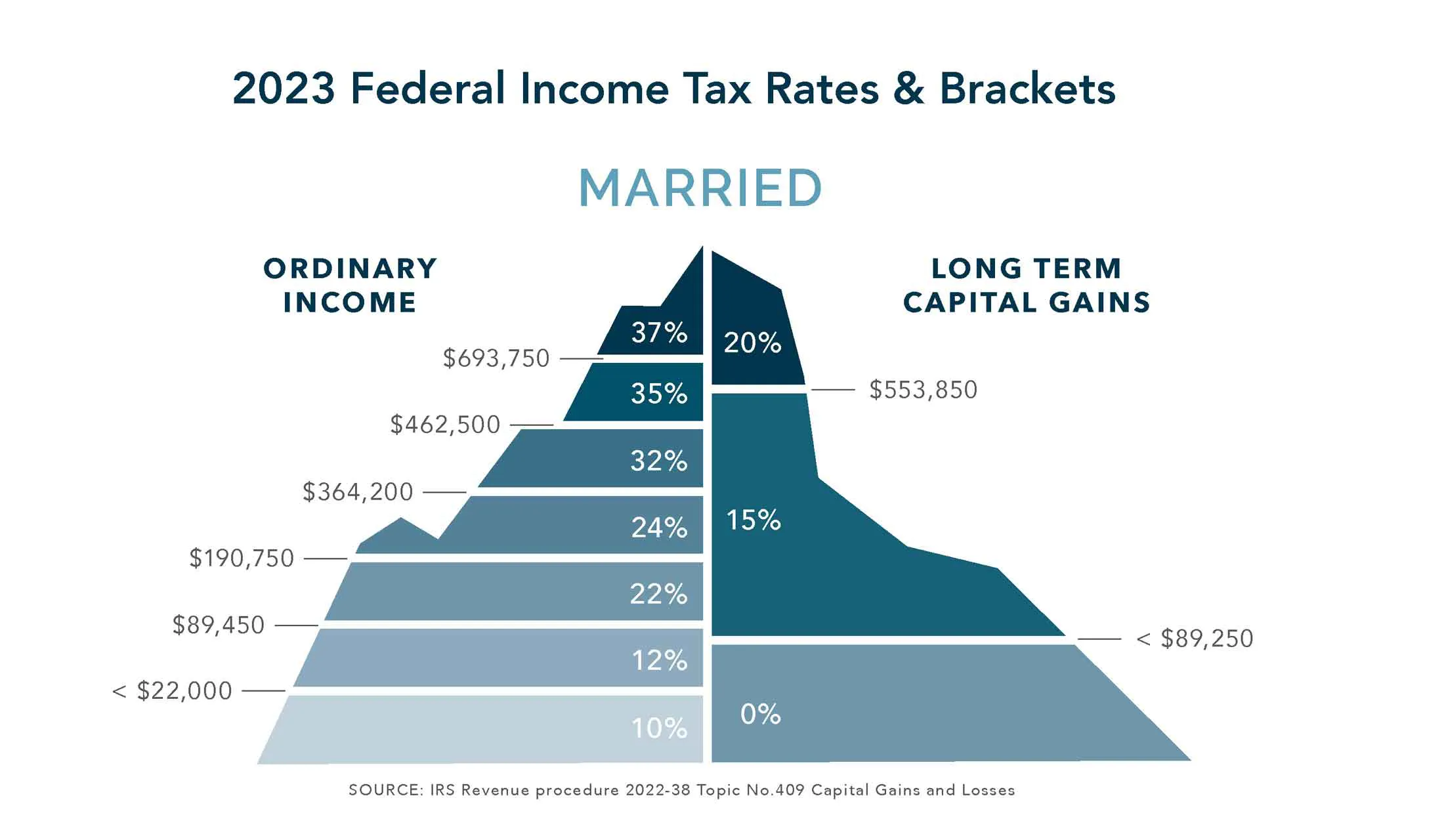

Increases to the Marginal Tax Brackets for 2023

Below are the charts reflecting the new income tax brackets for 2023. You will find a chart for those that are single and those that are married and filing jointly.

Importance of Ongoing Tax Planning

Larger standard deductions and higher marginal tax brackets for 2023 will provide many retirees more room in their highest marginal tax bracket than what they saw for 2022. This additional head space may provide tax planning opportunities. We can start to pull additional income forward before the expected increases in many of the marginal tax bracket rates in 2026. These expected increased in 2026 are due to the planned sunsetting of many of the personal pieces of the Tax Cuts and Jobs Act of 2017.

If ongoing tax planning and staying on top of retirement-related legislation aren’t already an integral part of your retirement plan, click here to schedule a time to talk.