From 1928 to 2020, the Standard & Poor’s 500 has posted positive results in 20 out of the 24 election years. The chart below gives us a bit of a history lesson. But it also should serve as a reminder that past performance does not guarantee future results.1

Stock Performance Outside of Election Years

Although election years have typically been positive for stocks, interestingly, the best year in a four-year presidential cycle has usually been the third year, followed by the fourth, then the second, and, finally, the first.1

Economists have theories about the reasons for this. They say that the first year of a term sees a recently elected president working to fulfill campaign promises, with the final two years being all about campaigning and trying to strengthen the economy before voters go to the polls.1

Although these theories may have some validity, they should only be one factor to consider when making investment decisions. There are too many other variables impacting the markets outside of politics. The Great Recession of 2008 and the COVID-19 pandemic of 2020 are examples of shocks to the economy that played a role in the election.

Do the Markets Care Who Wins the Presidency?

If the past is a prologue, it won’t matter much to the stock market whether the next president has an (R) or a (D) after their name.

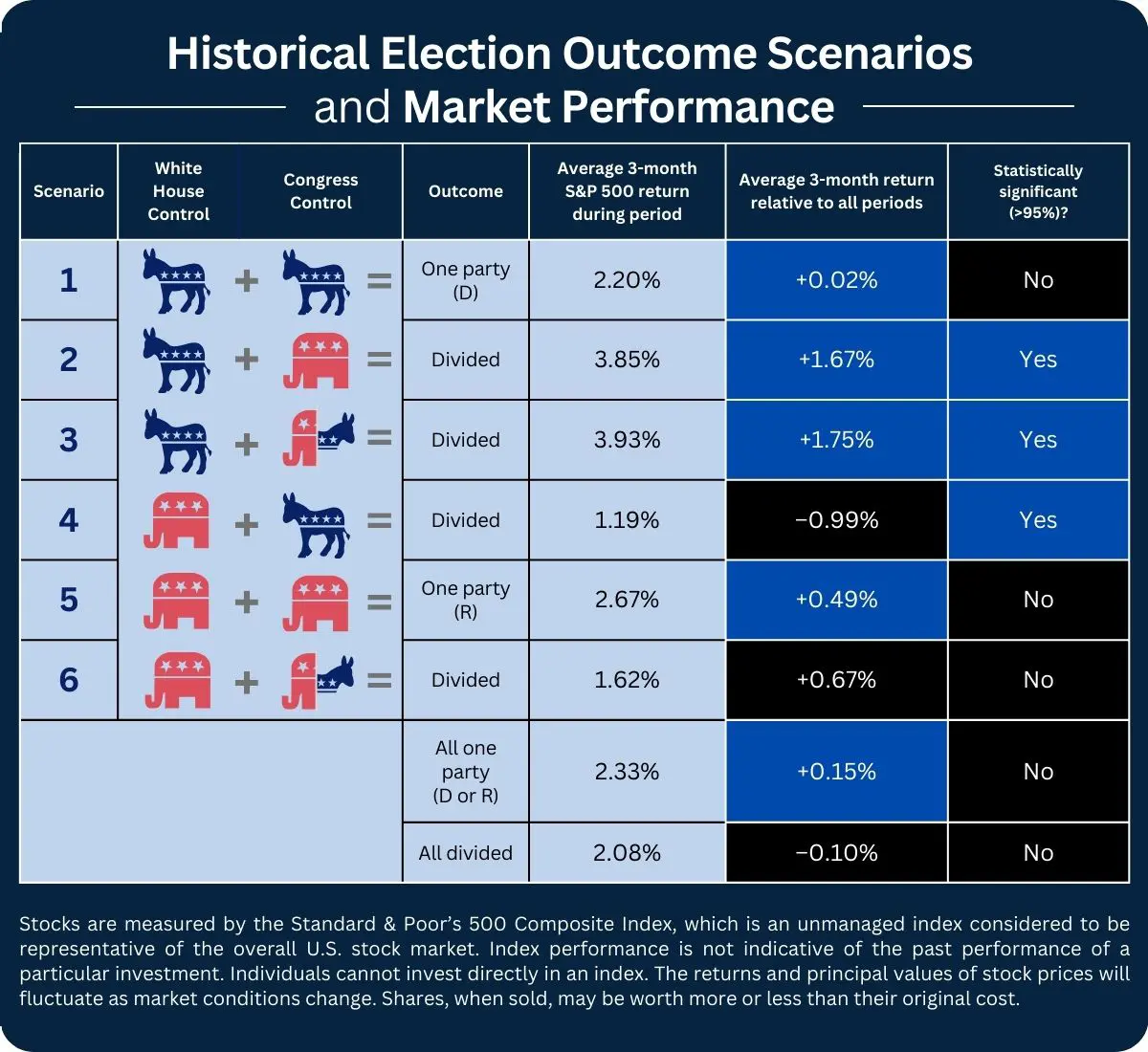

What has mattered more to the markets in the three months after a new president and Congress have taken office was the makeup of the government, how it was divided between the two major parties and the extent of that division.2

As the table below shows, Democratic control of the White House and either Republican or split control of Congress corresponded with the most positive returns above the market’s long-term average. On the other hand, Republican control of the White House and Democratic or split control of Congress resulted in returns below the market’s long-term average.2

As mentioned before, it’s important to remember that past performance does not guarantee future results. The 2024 election may mirror historical averages or deviate from the trends.

The Influence of the Economy, Inflation

Understanding how election results have affected the stock market over time is interesting. Still, data suggest that economic and inflation trends tend to have a more consistent relationship with market performance than who wins in November.

Improving growth and falling inflation generally create a more encouraging economic environment. Focusing on these factors may be more meaningful when evaluating market performance.2

Sticking with Your Strategy

Although it might be tempting to use events like an election to influence an investment strategy, it may not be the best approach. So don’t let short-term occurrences like elections distract you.

The best strategy is to have a well-thought-out approach to investing, a diversified portfolio, and a mix of asset classes that reflect your goals, time horizon, and risk tolerance. Keep in mind, however, that asset allocation and diversification are approaches to help manage investment risk. They do not guarantee against investment loss.

We’re Here If You Have Questions

We’re here to help. If you are a current client and would like to discuss your strategy, please contact us anytime. If you are working with another financial professional and would like us to review your overall approach, don’t hesitate to contact us.

![]()

- TheBalance.com, March 13, 2022. The S&P 500 Composite Index is an unmanaged index that is considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

- USBank.com, 2024