For most Americans, federal income taxes are a once-a-year inconvenience that raises its ugly head every spring. Filing our annual tax return brings with it the opportunity to gather multiple documents that we likely placed in that one file in the pile of folders next to the desk. Then we meet with an exciting tax preparer, and eagerly learn if we have a tax bill due or if we are receiving a refund. It has been my experience that this resulting tax bill or refund is the primary focus for many concerning their taxes. There is very little focus on exactly how much I paid in taxes for the year. Instead, the focus is on do I need to write another check or when can I spend that refund.

For those of us still in the workforce who have not retired just yet, we tend to pay little attention to the fact that the majority of the income taxes we pay comes directly from our paycheck before it hits our bank account. It’s a bit of “Out of sight, out of mind” as we focus on how to manage what was actually deposited into our checking account. Many are surprised when a tax review details the total dollars paid in federal income tax for a given year.

How Will My Taxes Change Once I Retire?

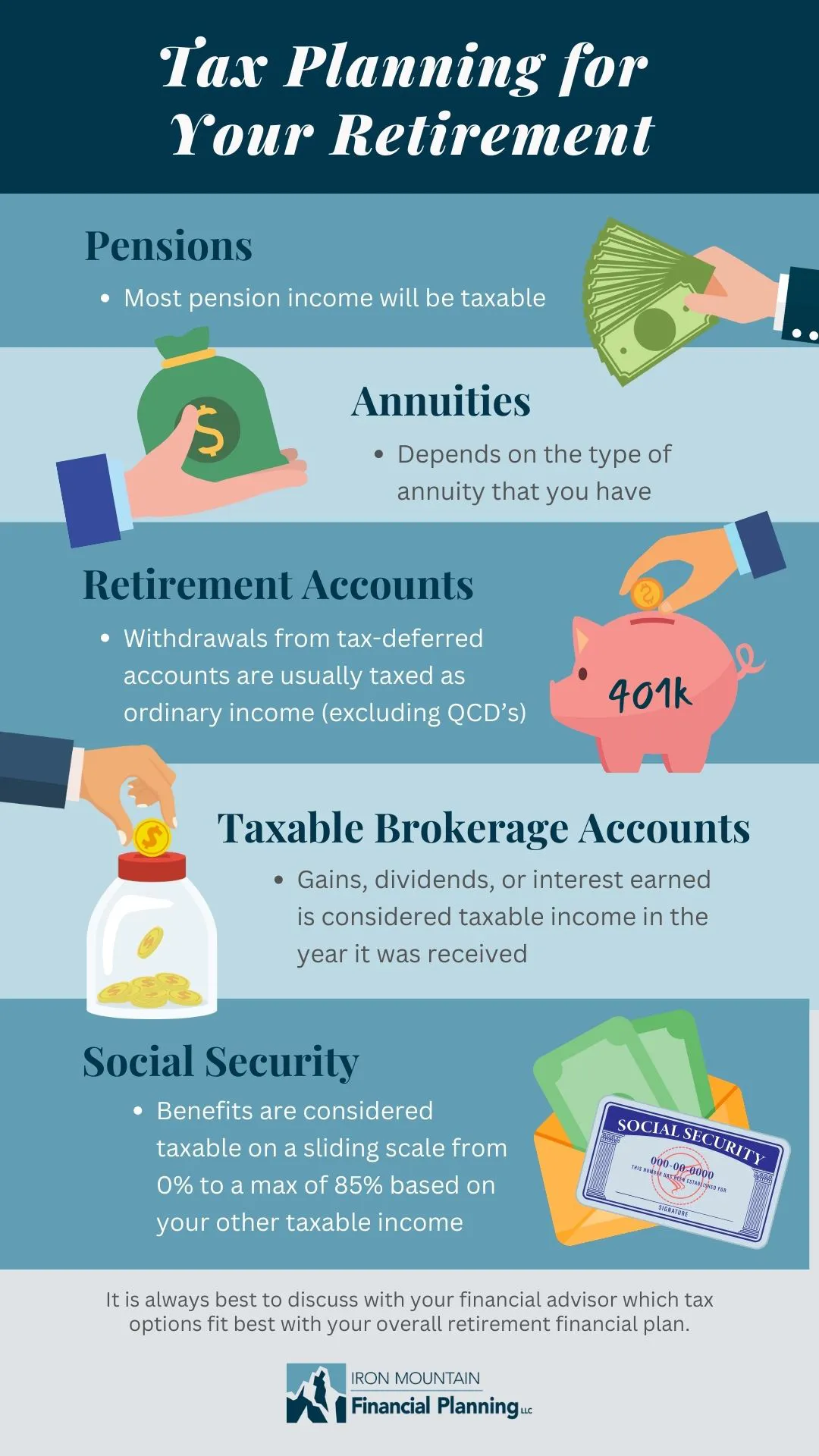

Now this income and tax situation changes significantly once we flip the switch to retirement. When that happens we are no longer receiving regular paychecks from our employer (Now I’m free from the man!). Instead, we are likely to have multiple sources of income from maybe a pension and/or an annuity, Social Security, and, for many, multiple retirement accounts. Each of these income sources has different tax implications.

Once we retire, it is now up to us to take the initiative and tell each income source if and how much to withhold for federal income tax.

How are Pensions Taxed?

We can start with pensions as they are almost always 100% taxable income taxed according to the ordinary income tax brackets. (I say almost as there exceptions to almost every rule, even this one.)

How is an Annuity Taxed?

The taxation of an annuity is dependent on if the annuity was qualified (initially purchased with tax-deferred dollars) or non-qualified (initially purchased with dollars you already paid taxes on).

Taxes on Qualified Annuity Payments

For qualified annuity payments, all payments will be 100% taxable income taxed according to the ordinary income tax brackets. The net cost of all premiums has not been taxed yet, nor has any of the gains in the annuity. You can bet the IRS is ready to reap this delayed benefit to them.

Taxes on Non-Qualified Annuity Payments

For non-qualified annuity payments from an annuity that was annuitized, the tax rules are different. Annuitizing an annuity is where you will receive a fixed amount for either a fixed period (think 10 years or 20 years certain) or life in exchange for giving the annuity company the current annuity balance. Each of the payments received will be a combination of a return of total premium paid and gains in the annuity. This is what is known as the exclusion ratio which will be calculated by the annuity company. It is basically calculated by dividing the net cost of the annuity contract by the number of payments you are expected to receive. This will provide the amount of each payment that is excluded from taxation. The balance of each payment will likely be considered taxable income taxed according to the ordinary income tax brackets.

For non-qualified annuity payments from an annuity with an income rider that was not annuitized, the initial payments are likely to be considered 100% taxable income until all gains in the annuity have been paid out. Once all of the gains in the annuity have been paid, the payments are likely to be considered return of your initial premium. The payments during this period of returning your initial premium will not likely be taxable income. And then once all of the initial premium has been paid out in payments, the payments will likely resort back to 100% taxable income. Pretty straightforward and easy to plan for right?

How are Retirement Accounts Taxed?

Traditional and Rollover IRA’s and deferred 401k accounts are the simplest. All of the contributions to these accounts were tax-deferred (meaning you received a tax-deduction in the year the contribution was made). Therefore, all distributions from these accounts are likely considered 100% taxable as ordinary income.

Roth IRA’s truly shine once we reach the distribution phase in retirement as all distributions are not currently considered taxable income as long as the following conditions have been met. These conditions are that you have reached 59 ½ and the first Roth IRA contribution you made was at least 5 years ago. Not necessarily the first contribution to this particular Roth IRA, but instead your first contribution to any Roth IRA. If you have reached 59 ½ but it has not been 5 years since your first Roth IRA contribution, then the return of contributions is not taxable but distributions of earnings will be.

How are Taxable Brokerage Accounts Taxed?

Unlike retirement accounts, any realized investment gains, dividends paid, or interest earned in a given year is considered taxable income in the year it was received. Tax-deferred retirement accounts have the advantage of deferring taxes on realized gains, dividends, and interest as taxes are paid when distributions are made from the account.

If the investment in a taxable brokerage account has been held for at least a year, then realized investment gains can be considered long-term capital gains and taxed according to the long-term capital gains tax brackets. This can be advantageous for some and not for others depending on where you fall in the ordinary income tax brackets. Realized investment gains that were held for less than a full year are usually taxed as ordinary income.

How is Social Security Taxed?

We saved Social Security for last because Social Security Retirement Benefits are not nearly as straightforward and is dependent on all of your other taxable income. The amount of your Social Security benefit considered taxable is dependent on all of your other taxable income as well as any non-taxable income (think muni-bonds) and half of your Social Security benefits for the year. In 2023, if this total exceeds $25,000 filing as Single or $32,000 filing a Married Filing Joint, then your Social Security benefits are considered taxable on a sliding scale from 0% to a maximum of 85% based on your other taxable income.

Some have annual income low enough where none of their Social Security benefits are considered taxable income. Others are on the opposite end of the spectrum where they max out at 85% of their Social Security benefits considered taxable income and any additional income from other sources does not increase the amount of taxable income considered from their Social Security benefits.

Many find themselves in a situation known as the “tax torpedo” where they are between these two extremes. This is where they have to pay income taxes on any additional taxable income they have and this additional taxable income makes more of their Social Security benefits taxable income. This can be brutal for some households.

How Do I Use this Information?

Tax planning can be very beneficial to soon-to-be or recently retired households as this allows us to run a tax projection to estimate where they will fall in the income tax brackets and how much total income tax may be due for the year.

Where a household falls in the tax brackets may influence which income sources to start when and can effect the size of distributions taken from various retirement accounts based on the tax consequences of distributions.

How much total income tax estimated to be due for the year prepares us to have the correct amount of withholding withheld from payments or distributions, or make estimated quarterly tax payments, so that we are not surprised by an unexpected tax bill upon filing our annual federal tax returns.

Are there different considerations for Single versus Married Couples?

There are in-fact often many different considerations for a single household versus a married couple. Married couples have two Social Security benefits to consider related to timing as well as may have multiple pensions as well.

While there are others, the most over-looked consideration for a married couple is what happens to the surviving spouse’s income taxes upon the passing of a spouse. The surviving spouse can often file a Married Filing Jointly for the year of the spouse’s passing, this preserves the more generous (never thought I’d type that about the IRS) Married Filing Jointly tax brackets for this one year. Most retired surviving spouses then do not qualify to file as a qualifying widow or widower the following two years as they do not have a child, stepchild, or adopted child to claim as a dependent. These retired surviving spouses then file as Single and their federal income taxes are drastically increased due to the smaller ordinary income tax brackets for single filers.

Plan Ahead For The Future

The changes in federal income taxes is just one area where it’s important to plan ahead for retirement so you are not surprised once you have transitioned to a fixed income. Other areas include how to transition the investment portfolio from a pure growth focus to a focus on a lifetime of income without locking it up out of reach, making sure your estate plan isn’t going to send a child further down the wrong path, making the most of your Social Security retirement benefits, how to transition to Medicare, or staying on top of the myriad of retirement related legislative and tax law changes.

If you are looking for help putting all of the pieces together to complete your retirement plan puzzle including taxes in retirement, click here to schedule a time to talk.