‘Tis the season for gratitude and hope. And it turns out, it is also the season when the Social Security Administration is busy delivering their IRMAA letters.

You’ll get this notice if you have Medicare Part B and/or Part D and Social Security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you. This notice will include information about Social Security’s determination and appeal rights. But what exactly is IRMAA?

What is IRMAA?

Medicare participants with income above a set threshold must pay a surcharge called IRMAA (Income Related Monthly Adjustment Amount) in addition to the standard monthly Medicare Part B and Part D premiums.

The Social Security Administration (SSA) determines who pays IRMAA based on their reported income from the 2 years prior. For 2023, the SSA looked at the 2021 tax returns to calculate if, and how much, IRMAA surcharge each Medicare participant must pay.

Which means the IRMAA surcharge is recalculated every year. If the Medicare participant’s income varies from one year to the next, the applied IRMAA surcharge can be increased, or eliminated.

IRMAA notices are only mailed to Medicare participants when the SSA has determined that the IRMAA surcharge applies. The IRMAA notice details the amount of the new Medicare Part B and Part D IRMAA surcharge as well as the reason for their determination.

Income Brackets for Part B and Part D IRMAA

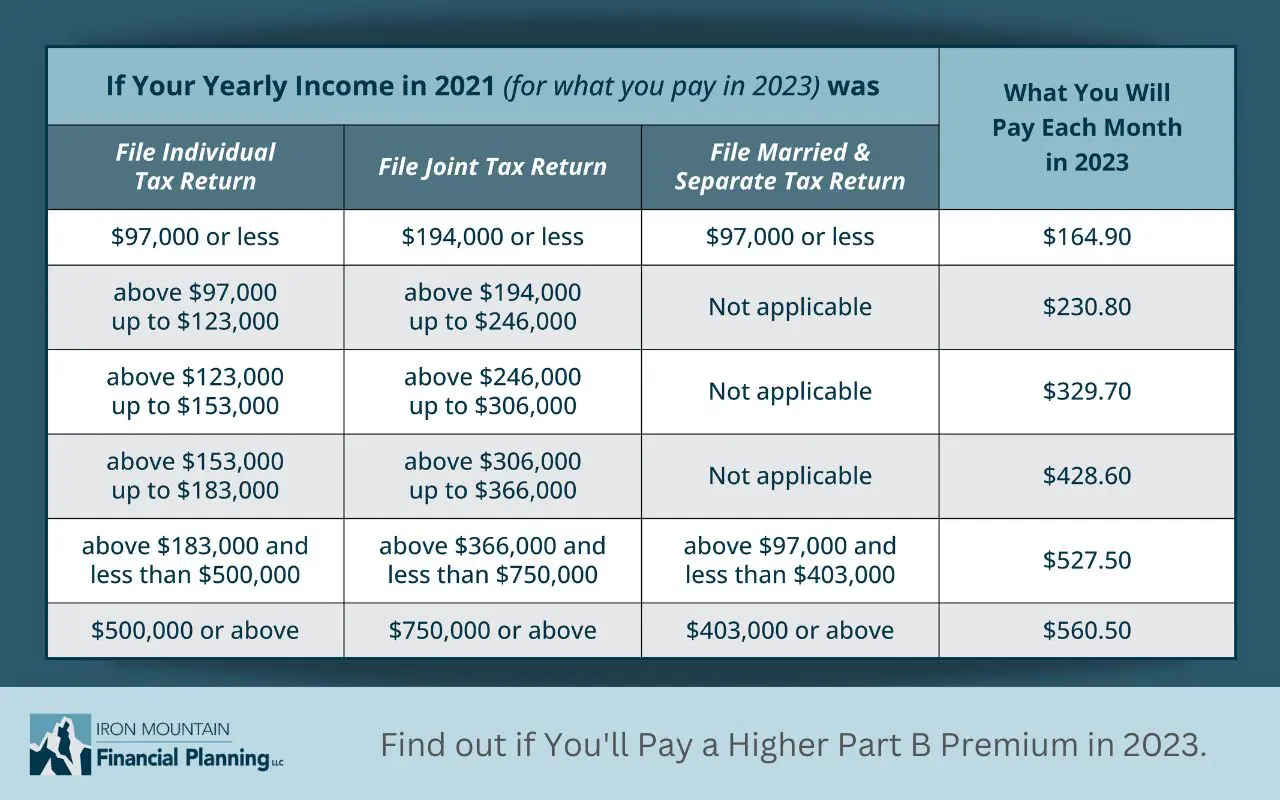

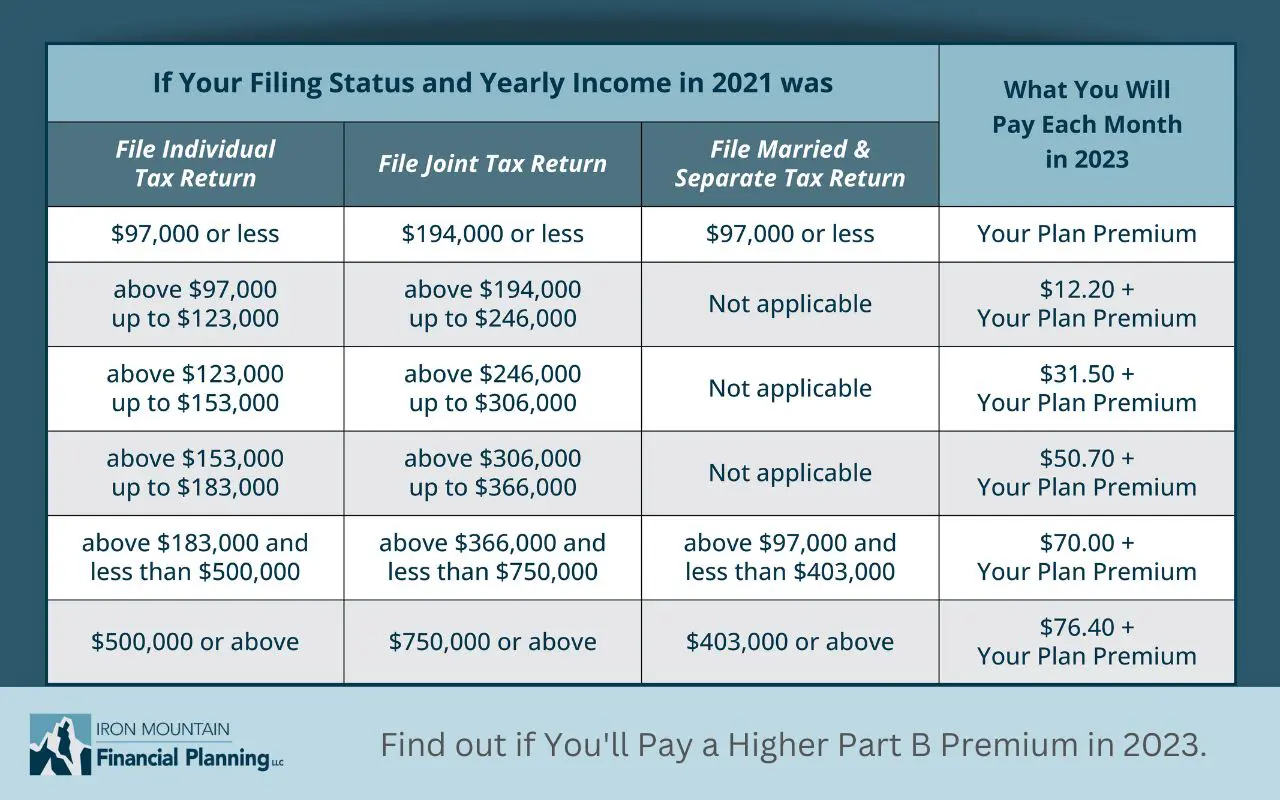

The income brackets for Medicare Part B and Part D are the same for 2023. In addition to the income, the IRMAA surcharge is based on filing status and Modified Adjusted Gross Income (MAGI) from 2 years prior.

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040 or 1040-SR) plus tax-exempt interest income (line 2a of IRS Form 1040 or 1040-SR). Below is a chart showing how income affects the monthly Part B premium and Part D IRMAA surcharge.

Part B Monthly Premiums for 2023:

Part D IRMAA Surcharge for 2023:

Source: https://www.medicare.gov/basics/costs/medicare-costs

Why Did the Social Security Administration Send Me a Letter About Aunt IRMAA?

Some common scenarios that a Medicare participant receives an IRMAA Social Security Letter include the following:

- New retirees age 65 or older where retirement income is lower than it was two years ago.

The SSA determines that the IRMAA surcharge is applicable based on the higher employed income from the two-year lookback. - Retirees with portfolio income that pushes them above the IRMAA threshold.

This commonly occurs when changing investment strategies in taxable investment accounts or when making large IRA distributions to fund one-time expenses such as vacation homes or rv’s. - Retirees who completed Roth Conversions focusing solely on filling all the 22% income tax bracket.

The top of the 22% income tax bracket is above the first IRMAA surcharge threshold for all filing statuses. This is a common oversight when analyzing the additional tax owed for a given amount of Roth Conversion.

Can the IRMAA Decision be Appealed?

Not all scenarios are eligible to appeal the IRMAA decision. But some can.

The five qualifying circumstances where a Medicare participant may be eligible to request a “New Initial Determination” are:

- An amended tax return since original filing

- Correction of IRS information

- Use of two-year-old tax return when the SSA used IRS information from three years prior

- Change in living arrangements from when the last time taxes where filed – often due to death or divorce.

- Qualified life-changing event

Source: https://www.ssa.gov/OP_Home/handbook/handbook.25/handbook-2506.html

Unfortunately for some Medicare participants, the determination that an IRMAA surcharge applies due to income increasing because of portfolio income and/or Roth Conversions are not eligible for appeal.

For others, the SSA lists the following eight Life-Changing Events:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income-producing property

- Loss of employer pension

- Receipt of settlement payment from a current or former employer

Source: https://www.ssa.gov/OP_Home/handbook/handbook.25/handbook-2507.html

How to appeal the IRMAA decision

A “New Initial Determination” can be requested by Medicare participants if their situation falls within the above eligibility criteria. This can be requested by either submitting a Medicare IRMAA Life-Changing Event form or calling the SSA.

The Medicare IRMAA Life-Changing Event form can be found here: https://www.ssa.gov/forms/ssa-44-ext.pdf

The completed Medicare IRMAA Life-Changing Event form can then be mailed to the local SSA office which can be found using the SSA Office Locator tool: https://secure.ssa.gov/ICON/main.jsp

Alternatively, Medicare participants can start by reaching out to the SSA to schedule an appointment. The above SSA Office Locator tool provides both the SSA National Hotline and the phone number of the local SSA office.

My experience has been that Medicare participants receive significantly better service from their local SSA office than from the SSA National Hotline.

Many retirees choose to address their IRMAA surcharge notice themselves using either of the methods listed above. Fortunately for my clients, my financial planning service includes coordinating with the Social Security Administration and Medicare for initial filing and on-going correspondence.

When a client receives an IRMAA letter with a surcharge notice, or any notice from the SSA or Medicare, we reach out to the local SSA office on speakerphone together and mutually explore the options and work towards resolution.

If help coordinating your initial filing for Social Security Retirement Benefits, determining which Medicare options fit your situation, or handling on-going correspondence from the SSA is of interest to you, click here to schedule a time to talk.