If you’re near retirement age and plan to start receiving Social Security retirement benefits, you may wonder if you have the option to include retroactive benefits in your first check. The answer depends on a few factors, including when you apply for benefits and your specific situation. Here’s what you need to know about Social Security payments and retroactivity.

Understanding Social Security Retroactivity

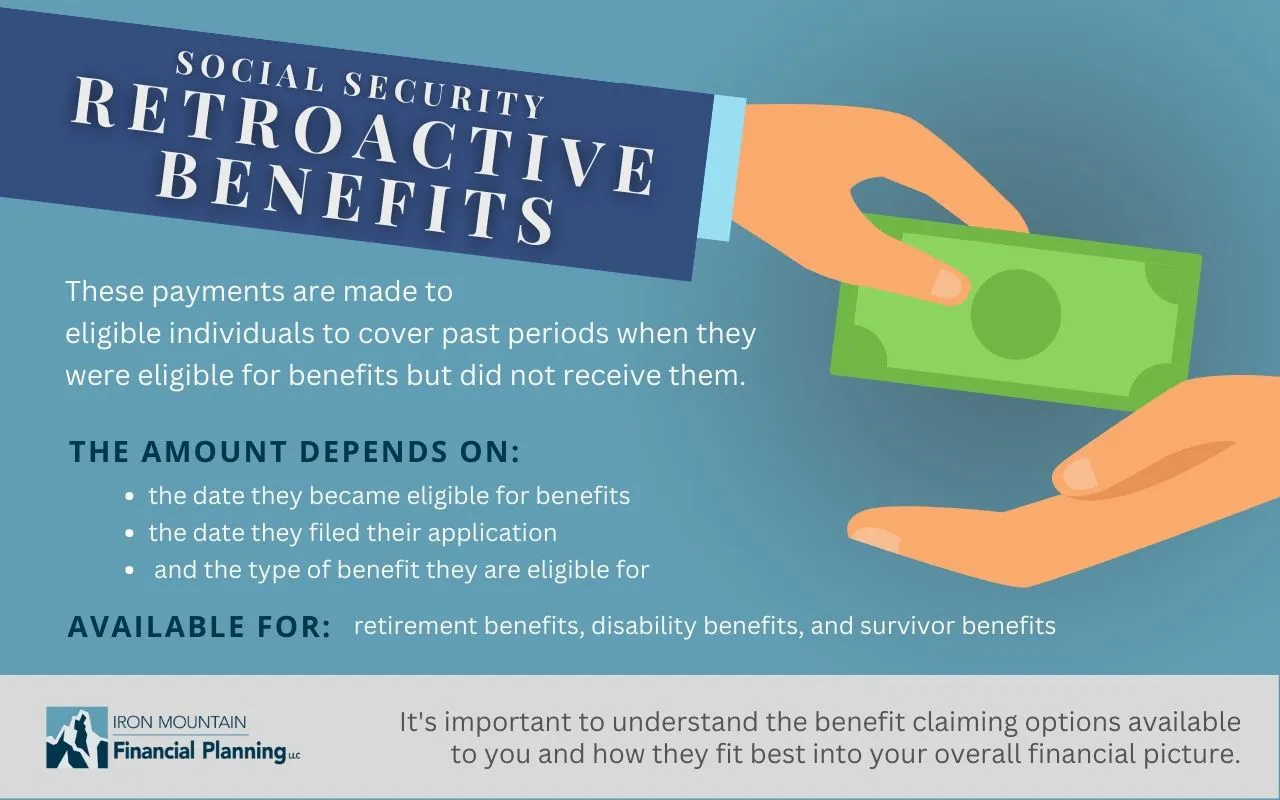

Social Security retroactivity refers to the payment of benefits for previous months that were not paid. This could be due to delays in the application process or, if you apply for benefits after your Full Retirement Age, you may be eligible for retroactive payments for up to six months prior to your application date.

How Retroactive Payments Work

Retroactive payments are payments that cover a period of time before you applied for Social Security retirement benefits. In some cases, you may be eligible for retroactive payments if you delayed applying for benefits until after your Full Retirement Age. However, the rules surrounding retroactive payments can be complex and vary depending on your individual situation.

It’s important to speak with a Social Security representative or financial advisor to understand your options and ensure you receive the maximum benefits you’re entitled to.

Exceptions to Retroactive Payments

While retroactive payments from the Social Security Administration are available in some cases, there are exceptions to this rule. For example, if you receive Supplemental Security Income (SSI), you will not be eligible for retroactive payments.

Additionally, if you receive benefits based on a deceased spouse’s or ex-spouse’s work record, you may not be eligible for retroactive payments if you wait too long to apply.

When Will You Receive Your First Social Security Check?

The specific timing of your first Social Security check depends on several factors, including your birthdate and the date you applied for benefits. Your first check will typically arrive the month after you begin your Social Security Retirement Benefits, and it will only cover the first month of benefits.

The specific day of the month that your benefit check is deposited depends on your Day of Birth and is outlined on the Social Security Administration’s website.

Click here for the SSA’s Payment Day Schedule.

When Will I Reach My Full Retirement Age?

Your Full Retirement Age is based on the year of your birth. If you were born between 1943 and 1954, then your Full Retirement Age is 66; born in 1960 or later, then your Full Retirement Age is 67. If you were born between 1954 and 1966, then use the Social Security Administration’s Retirement Age Calculator to determine your Full Retirement Age.

Click here for the SSA’s Retirement Age Calculator.

Do I have to wait until my Full Retirement Age to apply?

Regardless of Full Retirement Age, everyone who is eligible for Social Security Retirement Benefits can begin to receive benefits as soon as 62. Receiving Social Security Retirement Benefits prior to Full Retirement Age does reduce the amount of your monthly benefit. Every month prior to Full Retirement Age that you begin to receive benefits reduces your monthly benefit further. The Social Security Administration’s Retirement Age Calculator includes the reduction in benefits for each month prior to Full Retirement Age.

Click here for the SSA’s Retirement Age Calculator.

Tips to Maximize Your Social Security Benefits

Maximizing your monthly Social Security benefits can be important for ensuring financial stability in retirement. One way to do this is to delay claiming your benefits as long as you can, up to age 70. This typically results in a higher monthly benefit amount.

Additionally, Social Security Retirement Benefits are based on the 35 highest taxable earned income years and earning as much as possible during those years can also increase your benefit amount. This is one of the reasons that delaying Social Security Retirement Benefits typically results in an increasing benefit amount. For most workers, the end of their career is a time of their highest earned income and replacing a low income year increases the 35 year average. It’s important to understand all of the factors that go into calculating your Social Security benefits and to make informed decisions about when to claim them.

Will I Be Able To Retire Early?

There was a time when the decisions of when to retire from work, start Social Security Retirement Benefits, and move to Medicare were really one decision – when to retire – and all three of these occurred on the same day. This simply isn’t the case anymore. These three decisions absolutely should be coordinated, along with when to start receiving pension income and when and how to take income from your retirement savings; however, there is no requirement that they all fall on the same day.

It is important to understand the Social Security Administration’s Retirement Earnings Test if you are considering starting your Social Security Retirement Benefits prior to your Full Retirement Age and are planning to continue to work.

Click here for the SSA’s Retirement Earnings Test Calculator.

You should also be aware that the IRS is also interested in your Social Security Retirement Benefits. In fact, about 40% of those receiving Social Security Retirement Benefits must pay Federal Income Tax on some of their benefit amount. It is important to discuss this with your tax preparer prior or financial advisor to filing early so that you understand the potential tax implications as well.

Click here for the IRS’s FAQ on Social Security Income

If help coordinating your early retirement, planning for tax implications of starting Social Security Retirement Benefits, or handling on-going correspondence from the Social Security Administration is of interest to you, click here to schedule a time to talk.