Gift taxes are a subject that I get questions about on a fairly regular basis. The question itself implies some inaccurate information or misunderstanding around gift taxes.

It is generally asked by a parent trying to help one or more children financially. A concerned child may also be asking. They are usually looking for the best way to transfer their parent’s wealth over the remainder of the parent’s lifetime.

Both of these scenarios require additional uncovering because there is more understand why the question is being asked. For this post, we will simply stick to the mechanics of gifting.

The Quick Answer to Gift Taxes

For the previous five years, the annual gift tax exclusion had been held at $14,000. In 2018, the IRS increased the annual gift tax exclusion to $15,000 per recipient.

The amount is adjusted for inflation, however when they make adjustments, they can only be increased in $1,000 increments. The inflation rate has been low enough that it took five years for it to exceed the $1,000 increment. This is the origination of the dollar amount I have in question here.

As for who pays the taxes? It is the giver of the gift who is generally responsible for any taxes due for the gift. Not the receiver.

Gifts exceeding the annual exclusion need to be reported on your federal return and applied to your lifetime exemption. Continue reading for more info…

Under special circumstances, arrangements can be made for the receiver to pay any taxes due.

Our tax planning services aim to help minimize the taxes you pay through your lifetime, including those for gifts you may want to give.

The Details of Gift Taxes

Now technically we have answered the question, but I’m a financial advisor who always likes to dig a little deeper. Let me elaborate on how taxes are applied to gifts in this context.

In 2018, the annual gift tax exclusion allows any individual to gift up to the exclusion amount, $15,000/recipient, for both family and non-family members, for an unlimited number of recipients and have the gift be excluded from federal gift taxes.

Sounds simple right? How about an example?

Gift Tax Examples

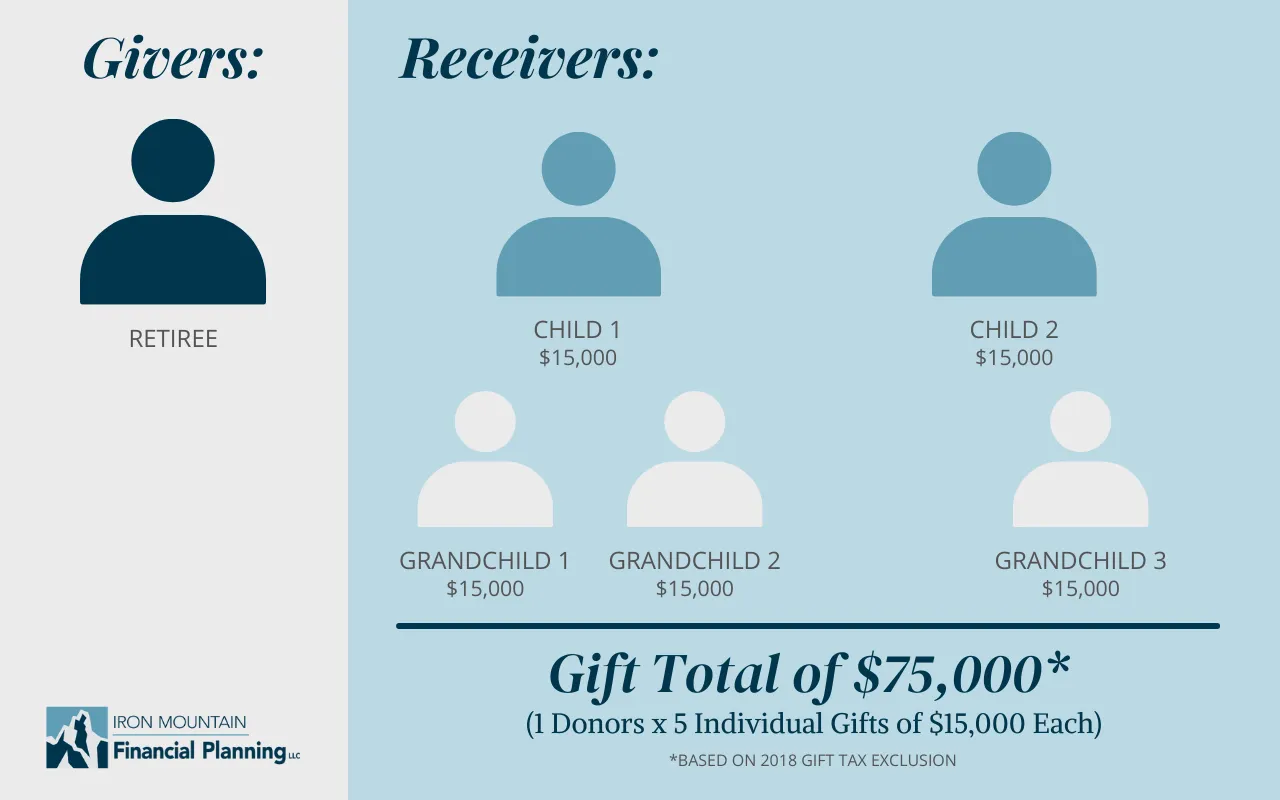

For example, if you had two children and three grandchildren; you could gift a total of $75,000 (5 individual gifts of $15,000 each) amongst the five of them.

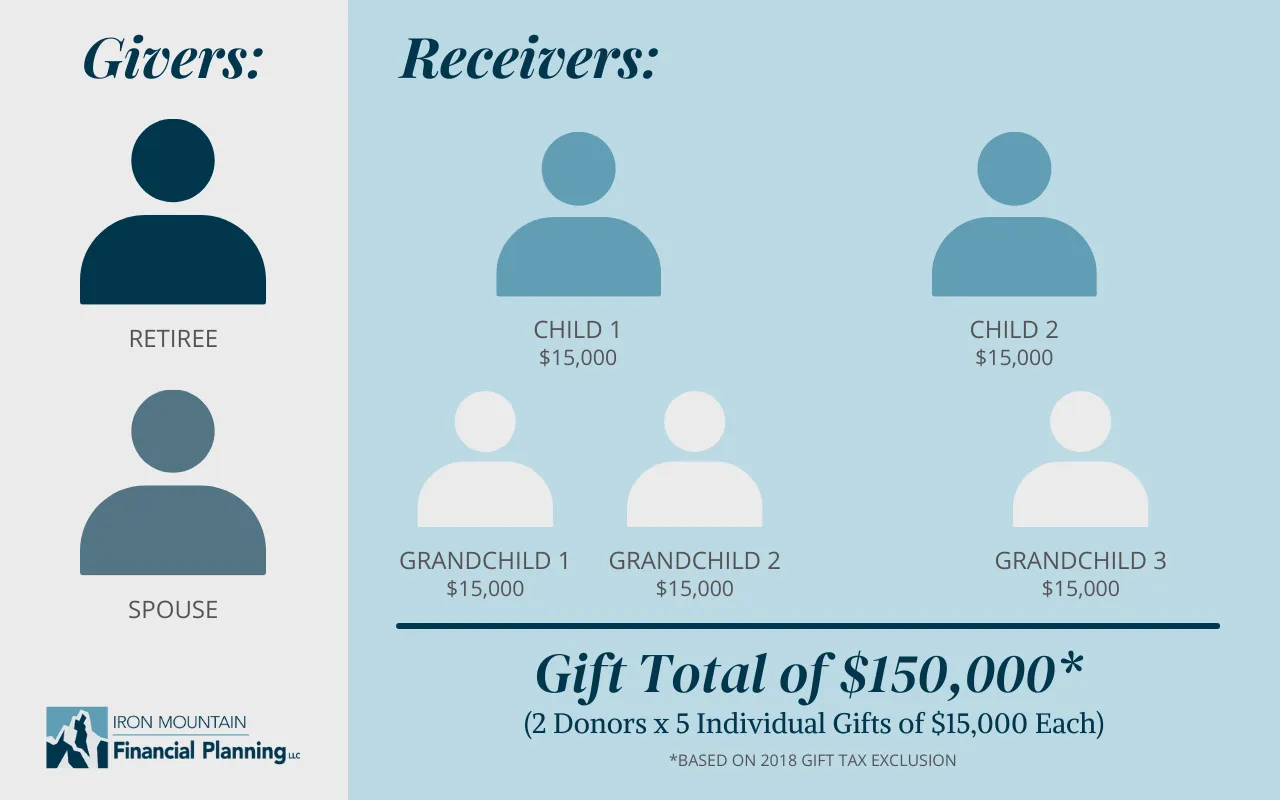

If you were married, both you and your spouse could do this for a gift total of $150,000 (2 donors each giving 5 individual gifts of $15,000 each).

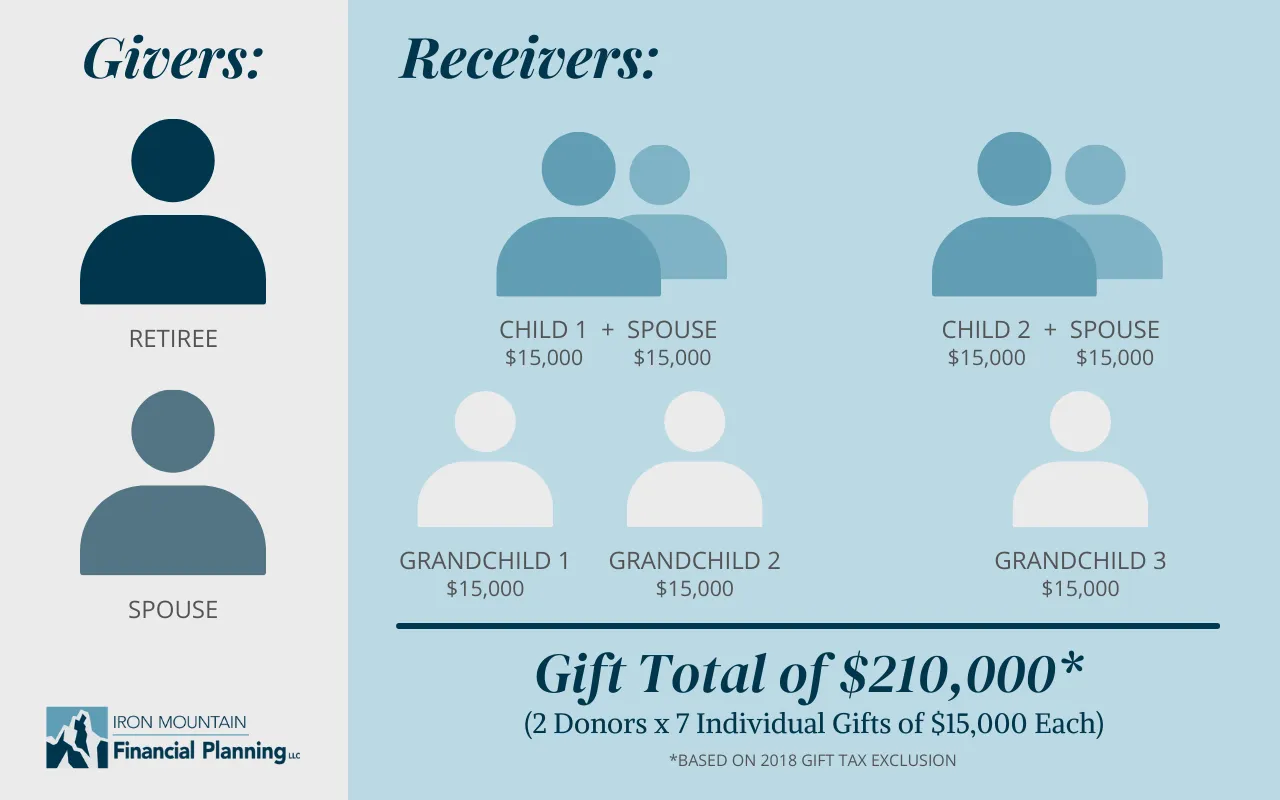

Taking this yet another step, if both of your children were married, both you and your spouse could gift a total of $210,000 (2 donors giving 7 individual gifts of $15,000 each).

Is that ALL I Can Give?

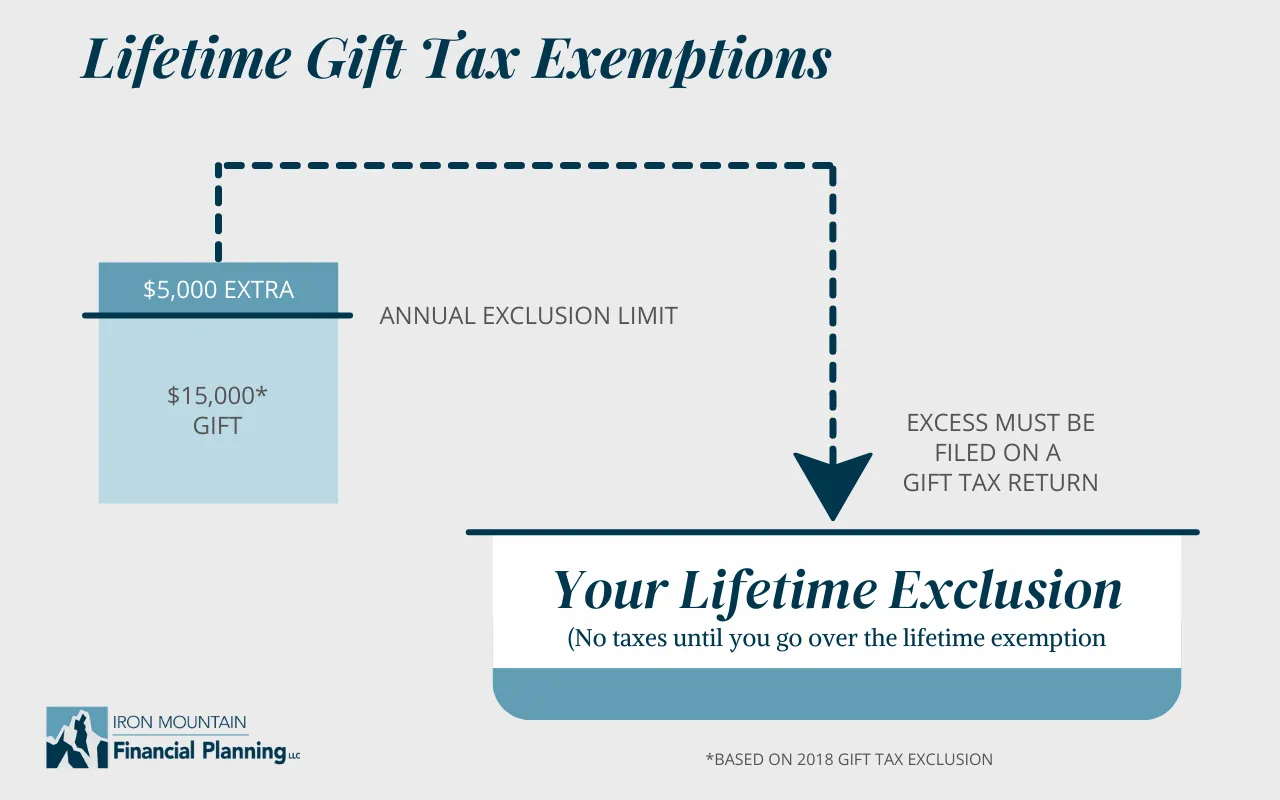

This usually leads people to believe they are limited to giving $15,000 per individual, which is not true. The annual gift tax exclusion only allows the gift to be excluded from federal gift taxes and prevents them from having to file a gift tax return.

So then does that mean that if you give a gift above the annual gift tax exclusion amount that you will owe taxes? Not necessarily.

Any gifts that exceed the annual gift tax exclusion amount are considered for federal gift taxes. The lifetime estate and gift tax basic exclusion amount can then be applied.

In 2017, the basic exclusion amount was $5,490,000 and for 2018, the Tax Cuts and Jobs Act increased the amount to $10,000,000 plus an inflation adjustment that, as of the writing of this article, has not yet been released.

If a gift exceeds the annual gift tax exclusion then it is applied to the lifetime basic exclusion amount. No federal income taxes are owed on the gift until the lifetime basic exclusion amount is exceeded.

It would require a gift tax return to be filed as the lifetime basic exclusion amount used needs to be tracked. Keep in mind that the lifetime exemption amount can also change over time. It can be increased as well as decreased depending on whomever is creating the laws, as just happened in 2018.

Time to Seek a Professional

As you are now being reminded, the IRS tax laws can get complicated very quickly and everyone’s retirement situation is unique. So the standard disclaimer is required stating that you should contact your tax professional concerning your specific situation around gift taxes.

I like to spend time reviewing your tax returns and analyzing how to minimize your taxes throughout your lifetime. Without careful planning, it’s very possible to have a higher tax bill in retirement than when you were working. Our tax planning services aim to help minimize the taxes you pay through your lifetime, including gift taxes.