In 1999, Bill Gates wrote, “How you gather, manage, and use information will determine whether you win or lose.” Companies looking to be successful in the future should heed these words when making decisions about implementing artificial intelligence (AI) across their businesses.1

Machines have been integrated into the workplace for decades, from robots on factory floors to spell check on your computer. The technological landscape shifted dramatically with the introduction of ChatGPT on November 30, 2022. This new AI language processor provides answers and data with human writing patterns and has been programmed with vast amounts of text data to understand context, relevancy, and how to generate human-like responses to questions. (ChatGPT is owned by OpenAI, a privately held company.)2

The new tool captured the imagination of business leaders and the public and forever changed the perception of machine learning. ChatGPT became the fastest-growing consumer app in history, reaching 100 million users in just two months.3

AI is already extending beyond chatbots and has the potential to restructure some industries. Beyond memos and term papers, AI-powered systems, tools, and platforms may have an economic impact everywhere, from homes to businesses to hospitals.

AI’s adoption rate and economic impact may happen faster than other technological innovations because its implementation is software-based, allowing it to be rolled out quickly online instead of relying on costly and time-consuming hardware installation.4

A growing demand for AI

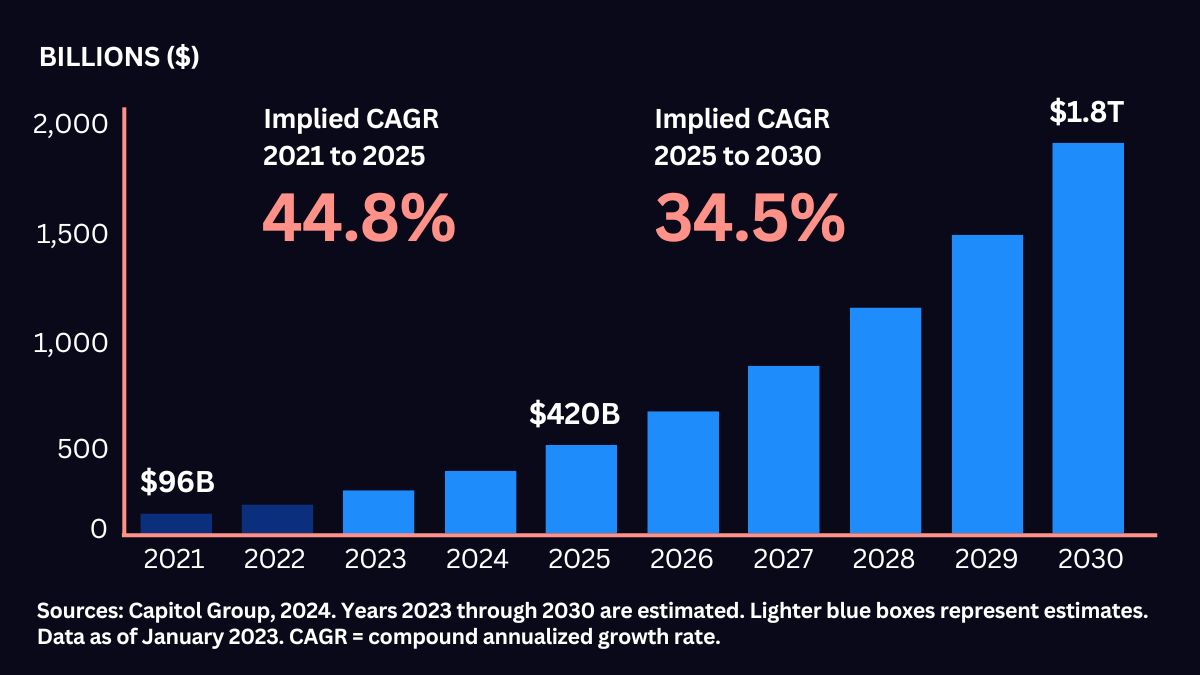

The global AI market was $95.6 billion in 2021 and is estimated to reach $1.8 trillion by 2030. That’s a 32.9% compound annualized growth rate (CAGR).4

As companies adopt AI, the economy may experience both immediate and longer-term implications. As Bill Gates observed 25 years ago, there will be winners and losers. AI applications have expanded, but they still have a long way to go before they become mainstream.

The forecasts or forward-looking statements are based on assumptions, subject to revision without notice, and may not materialize. Financial, economic, political, and regulatory issues may cause the actual results to differ from expectations.

Sectors that may benefit from AI

As AI matures, potential investment opportunities are emerging across the board. Some of the early beneficiaries of AI are well known, with early adopter firms like NVIDIA and Microsoft seeing adoption. But understanding AI means more than following a few well-known, high-profile names.

Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, timeframe, and risk tolerance.

Lesser-known AI companies also are making inroads. Just as the gold mining supply companies sold picks and shovels to miners during the 19th century California Gold Rush, there are several firms that are developing “picks and shovels” for AI.5

For example, semiconductor manufacturers, cloud infrastructure providers, AI chip designers, and even copper miners are needed to develop and scale AI. While they may not be as flashy as other firms, these nuts-and-bolts companies provide the critical tools for AI adoption.5

In addition, there are also any number of companies across industries that will use AI to improve their products and services. Healthcare, manufacturing, and consumer goods are just a few industries embracing AI to improve their offerings.

Here are a few market sectors that are at the forefront of AI:

Compute

To date, the most immediate opportunities have been concentrated in the segments related to the AI build-out, including semiconductor chip designers, equipment manufacturers, foundries, and other highly specialized companies. NVIDIA has become the most prominent “pick-and-shovel” AI play by designing graphic processing units that have seen a surge in demand from companies looking to build and train AI models. However, other companies in sectors like semiconductor equipment makers, chip foundries, memory chip suppliers, and server-makers may focus on AI. Other opportunities may be in the ecosystem of companies that provide specialty chemical solutions and higher electricity efficiency.4

Infrastructure

Other AI infrastructure firms include cloud companies, data centers, and networking firms. All are necessary to make AI possible. Due to the growth in AI, global spending on data center construction may reach $49 billion by 2030, according to McKinsey & Company. This growth may benefit many suppliers like electricity providers.4

Models

AI models are programs that use data to make certain decisions without human intervention. They require large datasets, computing power, and specialized engineers. For example, Microsoft-backed Open AI’s model is GPT4, Meta’s is Llama, and Alphabet’s is Gemini.4

Applications

Applications for AI may be one of the largest segments in terms of investment opportunities. One early example is CoPilot, which Microsoft embedded in its Office product as an add-on subscription. Beneficiaries may span industries worldwide as more use cases for AI become apparent.4

AI is now used for diagnostics, drug discovery, and patient services in healthcare. In financial services, many banks, insurance companies, and investment firms are starting to integrate AI into their back-office operations. Advertising and marketing companies employ AI to personalize ads, optimize campaigns, and predict consumer behavior.4

It’s not hard to imagine AI impacting multiple broad industries and individual companies in the coming years.

We are here to answer your questions.

New technologies don’t always live up to their potential, but some far outperform expectations and change our lives. The personal computer, the internet, and cell phones are a few we have seen in our lifetimes. Will AI be on that scale? Maybe. Over the coming years, we will continue to learn of new ways in which AI is impacting businesses and everyday life.

Financial headlines can be distracting, and the fear of missing out on the next big thing can lead to do-it-yourself investors making rash decisions. We are closely monitoring how AI is changing the investment landscape and determining what AI can look like in the future.

As financial professionals, we often have access to research opportunities that clients and prospects can find helpful during periods of rapid change. If you would like to hear about what we have at our fingertips, please contact our office.

![]()

- Capitalgroup.com, April 19, 2024

https://www.capitalgroup.com/advisor/ca/en/insights/articles/ai-investment-opportunity.html - Yahoofinance.com, October 4, 2023

https://finance.yahoo.com/news/3-picks-shovels-stocks-play-133634026.html