The Inflation Reduction Act of 2022 was signed into law back in August. While a few minor provisions went into effect in 2022, most of the key provisions impacting Medicare don’t go into effect until 2023 or beyond. Among these changes includes, for the first time, the ability for Medicare to negotiate directly with manufacturers for the price of select drugs that don’t have any competition.

The Inflation Reduction Act Directly Lowers Part D-Covered Insulin Costs

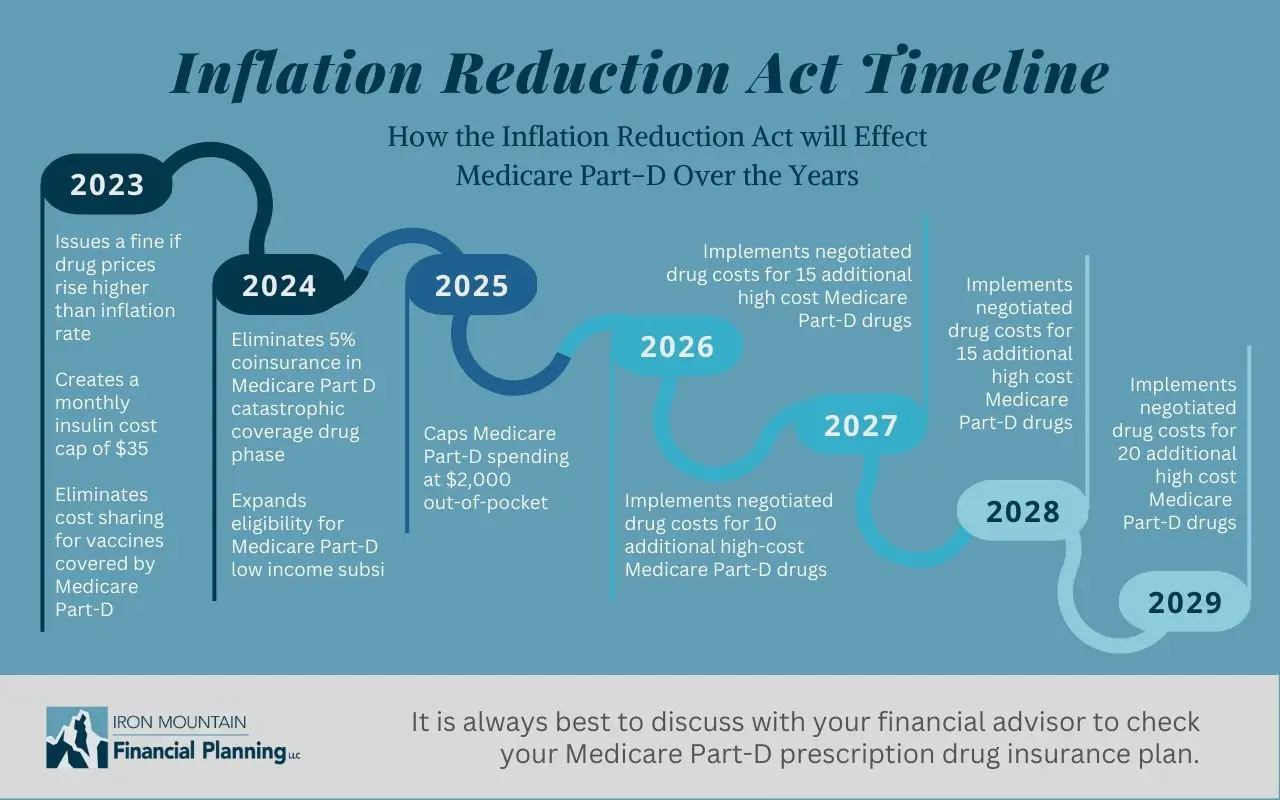

The Inflation Reduction Act singles out Part D-covered insulin specifically and limits the cost of a month’s supply at $35 when purchased in 60-day or 90-day supplies beginning January 1, 2023. The Act also adds insulin administered through a traditional pump as covered under Medicare Part B beginning July 1, 2023. Deductible payments are also eliminated for covered insulin products.

Reducing and Limiting Annual Medicare Part D Out-of-Pocket Costs

Beginning in 2024, copayment and coinsurance payments are eliminated in the catastrophic coverage phase of Medicare drug coverage. And, starting in 2025, participants yearly Part D out-of-pocket costs will be capped at $2,000. This change includes the option to pay in monthly amounts over the plan year instead of when they happen.

Medicare Negotiates (Some) Drug Prices

One of the more significant provisions of the Inflation Reduction Act within Medicare is the ability for Medicare to negotiate drug prices directly with manufacturers where there is no direct competition. The Departments of Defense and Veterans Affairs and the Indian Health Service have had this ability to negotiate drug prices for their programs for decades. The Inflation Reduction Act extends this to Medicare which will likely have a significant impact on some drug prices.

The implementation of Medicare negotiating drug prices is phased in over time. Medicare will announce the first 10 drugs to be negotiated in 2023. The drugs will be selected from a list of the highest spending, brand name Medicare Part D drugs that don’t have any competition. The negotiated, lower drug prices for the 10 drugs announced in 2023 will be available starting in 2026.

This process continues with Medicare selecting and negotiating 15 more Part D drugs in 2025 and again in 2026 with the negotiated, lower drug prices available starting in 2027 and 2028, respectively. Starting in 2028, and every year after, Medicare will increase the annual number of new negotiated Part D drugs to 20 with the negotiated, lower drug prices available two years later.

The Inflation Reduction Act Lowers Out-of-Pocket costs of Recommended Vaccines

Effective January 1, 2023, Medicare Part D participants will pay nothing out-of-pock for adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP), including the shingles and Tetanus-Diphtheria-Whooping Cough vaccines.

The adult vaccines recommended by the ACIP can be found here: https://www.cdc.gov/vaccines/acip/recommendations.html

Strengthening the Medicare Program

The Inflation Reduction Act improves the Medicare program’s financial health for current and future participants. It does this by lowering what Medicare spends for prescription drugs and limiting increases in drug prices.

Beginning in 2025, the Medicare program will include a new Manufacturer Discount Program. This new discount program requires drug manufacturers to pay discounts on specific brand-name drugs and on other types of drugs called biologics and biosimilars.

Definitions and examples of biologic and biosimilar drugs can be found here:

https://www.cancer.org/treatment/treatments-and-side-effects/treatment-types/biosimilar-drugs/what-are-biosimilars.html

Drug manufacturers will provide a 10% discount in the initial coverage phase and a 20% discount in the catastrophic benefit phase.

The Inflation Reduction Act also implements a requirement that drug manufacturers to pay annual rebates to Medicare if they increase prices of specified Part D-covered drugs above an allowable inflation rate from a 2021 base period. This went into effect for the 12-month period beginning on October 1, 2022, and will be in effect each 12-month period going forward. Similarly, beginning in 2023, drug manufacturers pay a quarterly rebate to Medicare if the prices of most single-source Part B drugs and biological products exceed a quarterly inflation-adjusted price.

I believe it would be in most Part D participants best interest to check their Part D prescription drug insurance plan next fall to see how their projected out-of-pocket expenses compare to other available plans.

It will be interesting to see how these changes to the Medicare program by the Inflation Reduction Act affect Part D prescription drug insurance premiums going forward. One of the side-effects of these changes is shifting some costs from the Medicare program to Part D insurance providers as well as to drug manufacturers.

Like most aspects of retirement, many retirees choose to manage their Medicare options themselves. For those who would like some unbiased help, my financial planning service includes reviewing and selection of Medicare options including traditional Medicare versus Medicare Advantage plans, MediGap plans, and Part D drug insurance plans.

If help deciphering how Medicare Program changes will affect you or getting help with your Medicare options is of interest to you, click here to schedule a time to talk.