What Does Terminating a Pension Plan Mean?

For current or former employees receiving a “Notice of Intent to Terminate” letter, the experience of opening the envelope is not much different from getting any letter from the IRS. Anxiety and stress levels become elevated. Speed reading ensues.

Many Pension Termination Questions

Come to Mind Ranging From:

• My pension can be terminated?

• Where did my pension go?

• Does this mean my employer is filing for bankruptcy?

• Is my job at risk?

As a side note, this unfavorable thought progression is common enough to have been given the formal name of “catastrophizing”. Often, it is where we mentally take a walk down the path leading to the absolute worst-case scenario.

Good news is that while employer bankruptcy CAN be the cause of terminating pensions, it is most likely not the cause.

Can a Pension Plan be Terminated?

The IRS and the Pension Benefit Guaranty Corporation (PBGC) have procedures in place for employers to end pension plans. Formally it was called “plan termination”.

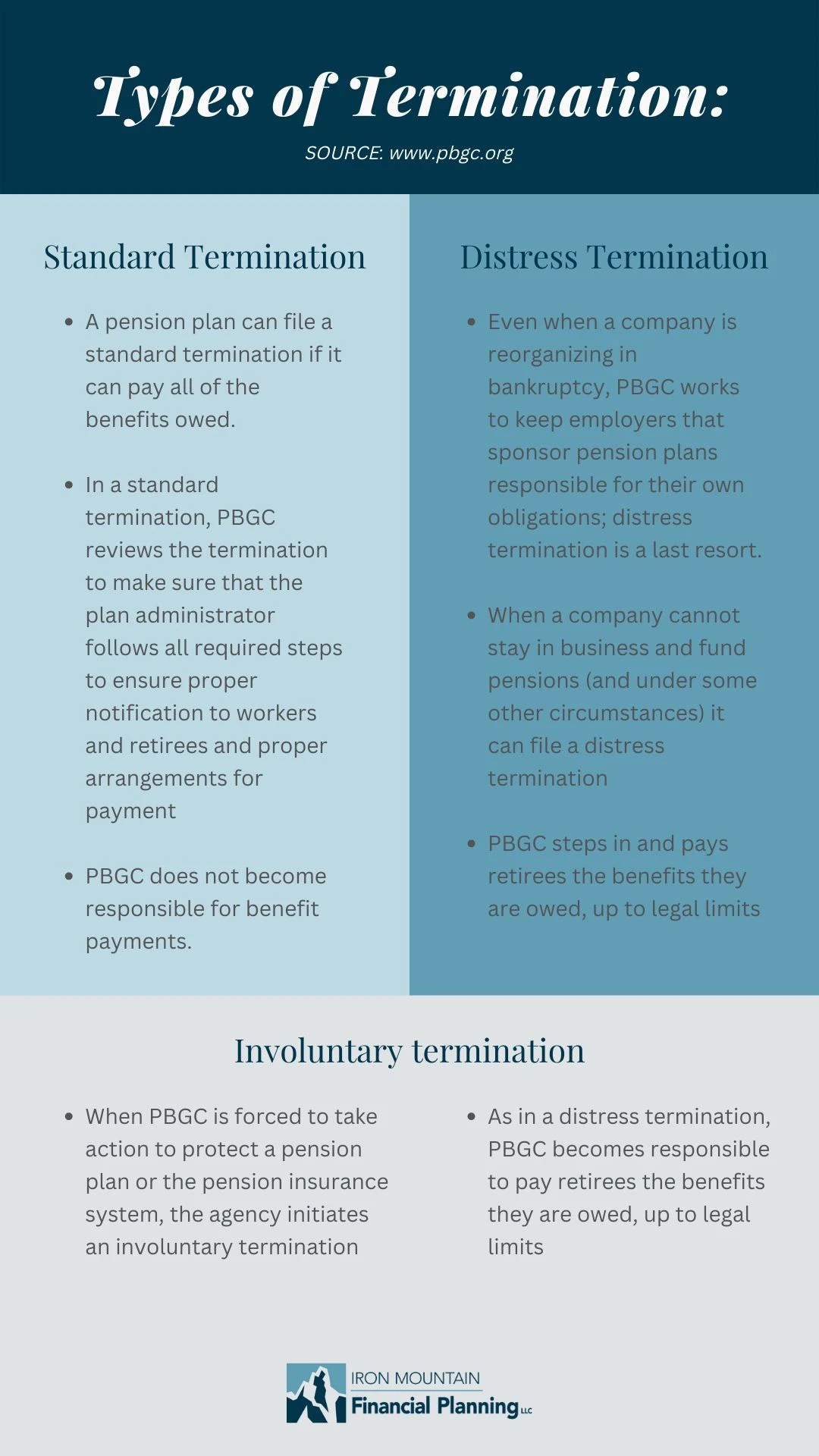

There are two paths typically used to terminate the pension: standard termination and distress termination.

Employers can end a pension using standard pension termination only after proving sufficient assets in the pension plan to pay all earned benefits to participants.

Plan assets are then used to buy an annuity from an insurance company to replace the pension. The employer is required to give advanced notice of which insurance company the annuity will be purchased through. Some pension plans will allow a lump sum payment option as an alternative to the annuity purchase.

Pensions can also be terminated by the employer using distress termination.

This applies when an employer is in financial hardship. The employer must prove they cannot remain in business unless the pension plan is terminated. The PBGC then steps in to take over the pension’s responsibilities.

And yes, there is a third path for pension termination known as involuntary termination that is initiated by the PBGC, not the employer.

Involuntary termination starts when the PBGC determines a pension plan does not meet minimum funding standards. Or when the pension is not able to be cover the promised benefits. The PBGC can then step in to take over the pension’s promised benefits.

Why Would a Company Terminate a Pension Plan?

It is increasingly more common for the termination of pension plans by employers.

A primary reason for pension termination is tremendous costs of the pension to the employer. A pension functions as a promise the employer has to provide a defined benefit. Also known as lifetime of pension payments or a future lump-sum payment.

An employer is on the hook to provide the promised benefit regardless of how investments perform or where interest rates go in the future. Regardless of how long employees live.

Financial risk burdened by the employer spurred a rise of defined contribution plan adoption as part of the Revenue Act passed in 1978.

The Revenue Act of 1978 included Section 401(k) which gave employees a tax-free way to defer compensation. Employers found tremendous value in matching employee contributions today versus guaranteeing a lifetime of payments.

Employers effectively transitioned the strain and risk of retirement income from their pension plan balance sheet to the employee’s balance sheet.

What Do I Do with My Terminated Pension?

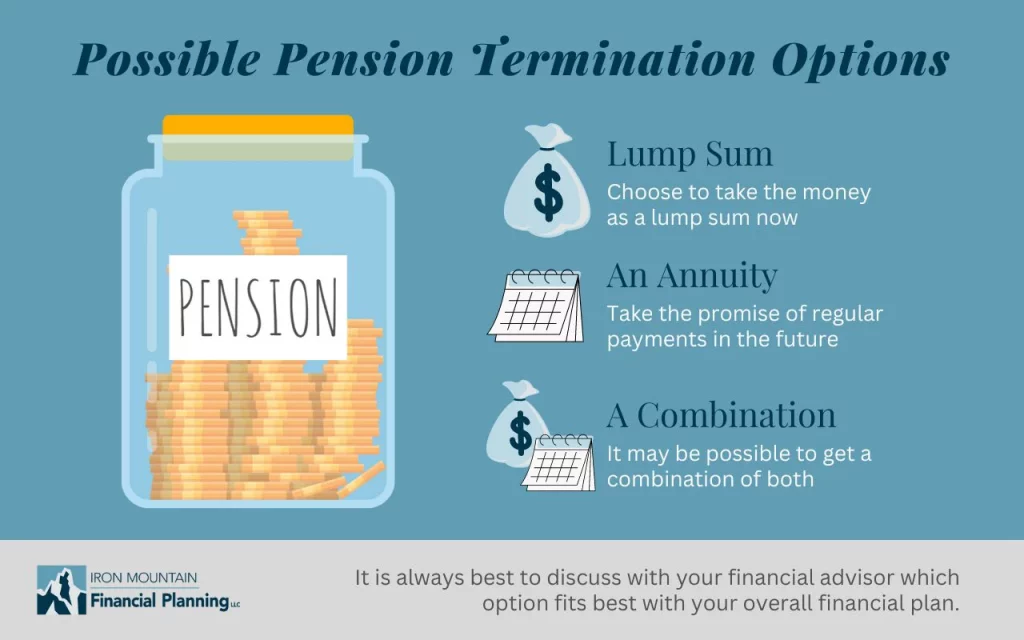

For many, the only option will be to utilize an annuity the pension plan purchased at termination.

While any PBGC benefits end with the pension termination, a state guaranty association may insure all or part of your annuity in its place.

Annuities, like any other financial tool, are useful correctly for the right individual. Tax-deferred growth on taxable dollars can be a benefit during high income tax years.

Also, many use a combination of an annuity and Social Security Retirement Benefits to cover basic retirement living expenses. Knowing that basic living expenses are covered allows investment management of your remaining retirement savings, regardless of market performance.

Others will have an option to receive a lump-sum payment in place of the annuity.

An increase in the number of available options can provide more favorable outcomes. It also tends to produce more anxiety and stress around making the right decision.

I recommend to analyze which option fits best with your overall financial plan. Examples including possible considerations are included in our article, Understanding Arch Coal Pension Plan Benefit Options.

If you’re looking for help putting all of the pieces together regarding a recent pension termination, click here to schedule a time to talk.